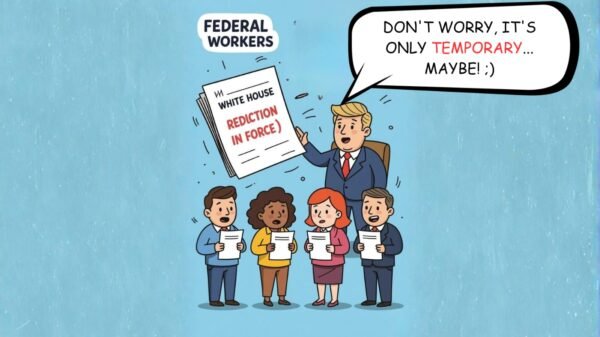

The administration of U.S. President Donald Trump has informed Consumer Financial Protection Bureau (CFPB) staff of a temporary shutdown. An internal email shared Monday with AFP confirmed the closure of its Washington headquarters and the suspension of all work.

Acting CFPB Director Russell Vought informed employees they should not report to work during the closure. “Please do not perform any work tasks,” Vought stated, instructing staff to halt all activities. Vought, now leading the White House Office of Management and Budget, was also behind Project 2025, a conservative reform plan.

He further instructed that staff must obtain his written approval before performing any urgent work tasks. Otherwise, employees were directed to “stand down from performing any work task.”

Established after the 2008 financial crisis, the CFPB is responsible for protecting consumers from corporate misconduct. However, Republicans have criticized the agency, claiming it overreaches in its regulatory authority. Some Trump supporters, including Elon Musk, have even called for its dissolution.

The White House released a statement on Monday calling the CFPB a “woke, weaponized arm of the bureaucracy.” The statement argued that the agency unfairly targets certain industries and individuals disliked by elites.

Pausing work at the CFPB and closing its offices appears to be an attempt to weaken its regulatory power. Since completely shutting down the agency requires congressional approval, this move limits its operations without formally dissolving it.

Democratic Senator Elizabeth Warren, a strong CFPB supporter, responded by criticizing the administration’s decision.

The CFPB’s temporary shutdown raises concerns about the future of consumer protection policies in the U.S. Critics argue that restricting the agency’s power benefits large corporations at the expense of ordinary Americans. The decision highlights ongoing political battles over government regulation and corporate oversight.